Featured

Table of Contents

- – Everything about Restoring Personal Credit His...

- – The smart Trick of Understanding Multiple How ...

- – The Buzz on Common False Beliefs Regarding Ho...

- – The Buzz on Finding Help for Your Financial R...

- – The Ultimate Guide To How to Never Repeat th...

- – 7 Simple Techniques For Practical Tips After...

Some financial institutions are much more ready to offer negotiations or difficulty programs than others. Obtaining charge card financial obligation forgiveness is not as simple as requesting your balance be removed. It requires preparation, documents, and arrangement. Financial institutions do not readily supply financial obligation forgiveness, so recognizing exactly how to provide your situation effectively can improve your possibilities.

I would certainly like to go over any kind of options available for decreasing or settling my debt." Financial obligation mercy is not an automatic option; in a lot of cases, you need to negotiate with your creditors to have a section of your balance minimized. Bank card companies are usually open up to negotiations or partial forgiveness if they believe it is their finest opportunity to recuperate some of the cash owed.

Everything about Restoring Personal Credit History Following Bankruptcy

If they provide complete mercy, get the arrangement in writing before you accept. You might need to send a formal composed demand clarifying your difficulty and just how much mercy you need and offer paperwork (see following area). To discuss successfully, attempt to understand the creditors position and use that to provide a solid case as to why they should deal with you.

Here are the most typical errors to avoid in the procedure: Financial institutions won't just take your word for it. They require evidence of economic challenge. Constantly ensure you receive confirmation of any mercy, negotiation, or hardship strategy in composing. Creditors might offer much less relief than you need. Discuss for the ideal feasible terms.

The longer you wait, the more costs and rate of interest build up, making it harder to qualify. Financial debt forgiveness involves legal factors to consider that borrowers need to understand prior to continuing. Customer security legislations control just how creditors handle forgiveness and settlement. The following government laws help shield customers looking for financial debt mercy: Restricts harassment and violent debt collection techniques.

The smart Trick of Understanding Multiple How to Protect Yourself From Financial Scams When in Debt Available Today That Nobody is Discussing

Calls for creditors to. Makes certain equalities in loaning and settlement arrangements. Restrictions costs and prevents unexpected interest rate walks. Needs clear disclosure of settlement terms. Prohibits financial obligation settlement firms from charging upfront costs. Needs firms to disclose success rates and possible dangers. Recognizing these securities assists prevent rip-offs and unreasonable lender methods.

This time framework varies by state, generally between 3 and 10 years. Once the law of constraints runs out, they generally can not sue you any longer. Making a repayment or even acknowledging the financial debt can reboot this clock. Even if a creditor "fees off" or creates off a financial obligation, it does not indicate the financial debt is forgiven.

The Buzz on Common False Beliefs Regarding How to Protect Yourself From Financial Scams When in Debt

Before accepting any layaway plan, it's a great concept to inspect the statute of limitations in your state. Legal effects of having financial obligation forgivenWhile debt forgiveness can eliminate economic problem, it comes with prospective legal effects: The internal revenue service treats forgiven debt over $600 as gross income. Debtors get a 1099-C form and should report the amount when filing taxes.

Here are some of the exemptions and exemptions: If you were bankrupt (meaning your complete debts were above your overall properties) at the time of forgiveness, you may leave out some or all of the terminated financial obligation from your gross income. You will require to load out Form 982 and connect it to your tax obligation return.

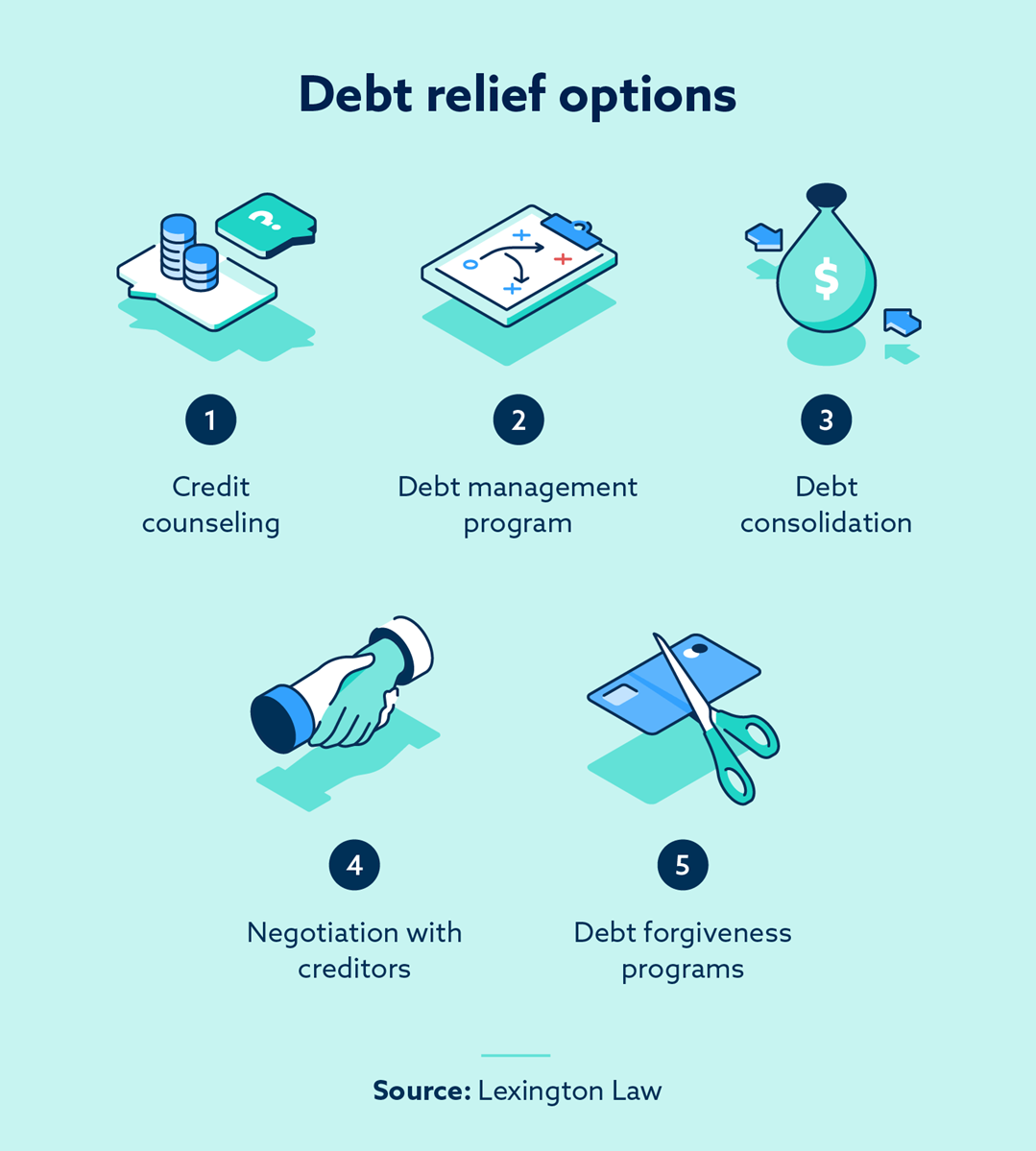

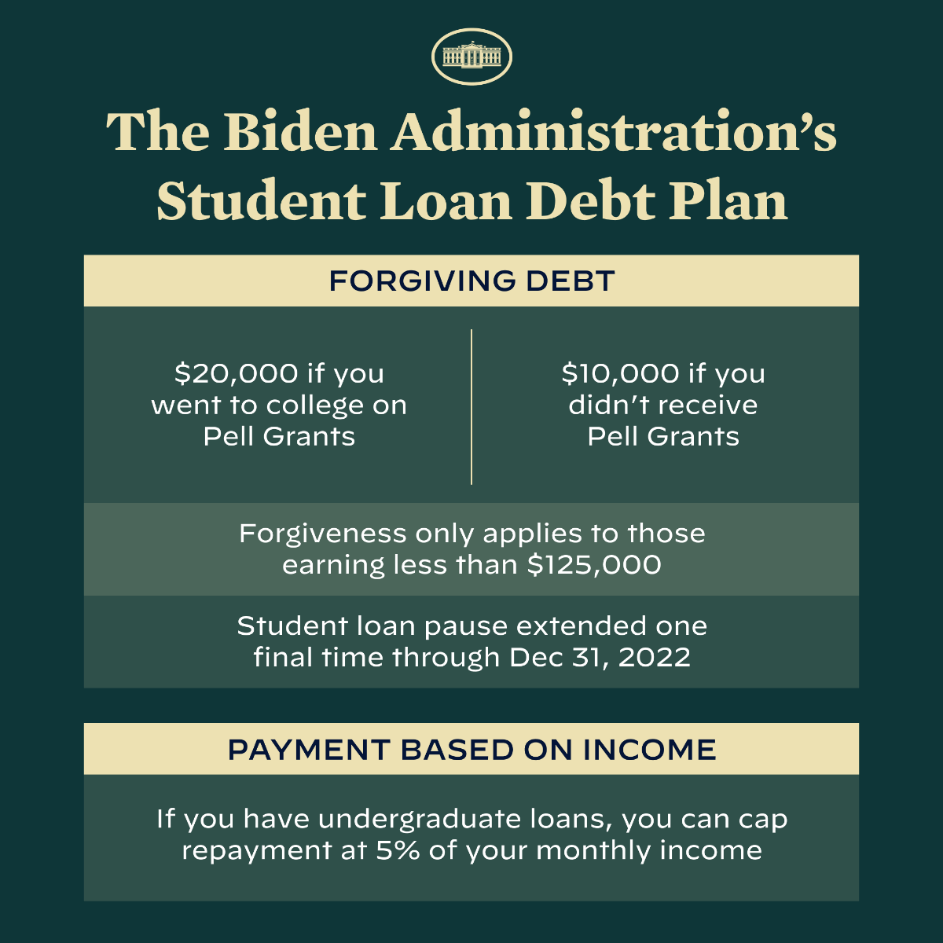

While not connected to charge card, some student funding mercy programs permit financial obligations to be canceled without tax repercussions. If the forgiven financial obligation was connected to a qualified ranch or organization procedure, there might be tax exemptions. If you do not receive financial debt forgiveness, there are different financial debt alleviation methods that may work for your scenario.

The Buzz on Finding Help for Your Financial Recovery Journey

You make an application for a brand-new financing huge sufficient to settle all your existing credit scores card balances. If accepted, you make use of the new finance to repay your charge card, leaving you with just one regular monthly repayment on the consolidation finance. This streamlines financial debt monitoring and can conserve you money on interest.

Crucially, the firm bargains with your creditors to lower your interest rates, significantly decreasing your total financial obligation worry. They are a wonderful financial obligation solution for those with poor credit history.

Allow's face it, after a number of years of greater rates, cash doesn't go as much as it used to. About 67% of Americans claim they're living paycheck to income, according to a 2025 PNC Bank study, that makes it hard to pay for financial obligation. That's particularly true if you're carrying a big financial debt balance.

The Ultimate Guide To How to Never Repeat the Previous Patterns After How to Protect Yourself From Financial Scams When in Debt

Loan consolidation lendings, financial debt monitoring plans and repayment strategies are some techniques you can make use of to decrease your debt. If you're experiencing a major economic difficulty and you've exhausted other choices, you may take an appearance at financial debt forgiveness. Financial debt mercy is when a loan provider forgives all or several of your superior balance on a lending or other credit scores account to help relieve your financial obligation.

Financial debt mercy is when a lender concurs to clean out some or all of your account balance. It's a strategy some people use to minimize financial debts such as credit cards, individual finances and trainee financings.

The most widely known choice is Public Service Lending Forgiveness (PSLF), which cleans out continuing to be federal finance equilibriums after you work full time for an eligible employer and make repayments for 10 years.

7 Simple Techniques For Practical Tips After How to Protect Yourself From Financial Scams When in Debt

That suggests any not-for-profit health center you owe might be able to offer you with financial obligation relief. Over half of all U.S. medical facilities use some kind of clinical financial obligation relief, according to person solutions support team Dollar For, not simply not-for-profit ones. These programs, typically called charity treatment, decrease or perhaps eliminate medical costs for certified people.

Table of Contents

- – Everything about Restoring Personal Credit His...

- – The smart Trick of Understanding Multiple How ...

- – The Buzz on Common False Beliefs Regarding Ho...

- – The Buzz on Finding Help for Your Financial R...

- – The Ultimate Guide To How to Never Repeat th...

- – 7 Simple Techniques For Practical Tips After...

Latest Posts

The smart Trick of Understanding Debt Relief Options for Overwhelmed Americans That Nobody is Talking About

Recession That Affect Rising Need Are Seeking Debt Forgiveness Can Be Fun For Anyone

The Financial Consequences What You'll Pay for Bankruptcy Counseling PDFs

More

Latest Posts

The smart Trick of Understanding Debt Relief Options for Overwhelmed Americans That Nobody is Talking About

Recession That Affect Rising Need Are Seeking Debt Forgiveness Can Be Fun For Anyone

The Financial Consequences What You'll Pay for Bankruptcy Counseling PDFs